Who likes shopping? Raise your hand. How about shopping for Medicare? I think I lost a few of you.

Medicare Shopping

When I shop for groceries, I must get prepared. The choices are overwhelming! I mean, how many brands of pineapple are there? Then I must decide if I want it crushed, sliced, whole, or chunked! If I properly prepare, I will have my list for what I need, based on recipes I plan to make. Fortunately, I can narrow down some decisions by looking at my list.

Just like grocery shopping, shopping for Medicare needs preparation. The choices are just as overwhelming as the modern-day grocery store! Sometimes you need guidance and must ask a store clerk how to find and item. If you are at a specialty store, you may be able to ask more specific questions about a product like, what types of herbs pair best with what types of meats or wine pairings.

Just like at the specialty store, Simco has specialists that can help you to discover what flavor of Medicare would work for you! (see what I did there?) We will ask some questions to get to know what services you are looking for based on your current needs. In doing so, we will be building your shopping list. Then we will look at the products that are available, to see what makes the best sense for you.

What does a Medicare shopping list look like?

The following items are important to have for meeting with a Medicare Specialist. Bring what applies to you:

- Your Medicare card. New cards were issued a few years ago, so be sure you have the current one. They no longer contain social security numbers.

- Your current insurance cards.

- Your EPIC card if you are a member of the Elderly Pharmaceutical Assistance Program.

- A current list of your medications. This list should include the medications dose, how often you take them, how frequently you fill them, whether they are a tablet, capsule, or solution, and if your medications are in a container such as a bottle, tube, jar or vial, and what size? The more specific you are will help us get you the most accurate quote.

- You will also want to bring a list of your current providers, meaning anywhere that you get your services or may potentially get services. This includes hospitals, both local and city, in case you have complex needs, as well as your pharmacy.

- If you are trying to decide whether to choose a Medicare plan vs COBRA, Retiree Coverage, FEHB, etc. and you have that plan’s contract information, bring that as well.

Medicare Timeline

There are only certain times of the year when you can sign up for Medicare or change your Medicare coverage.

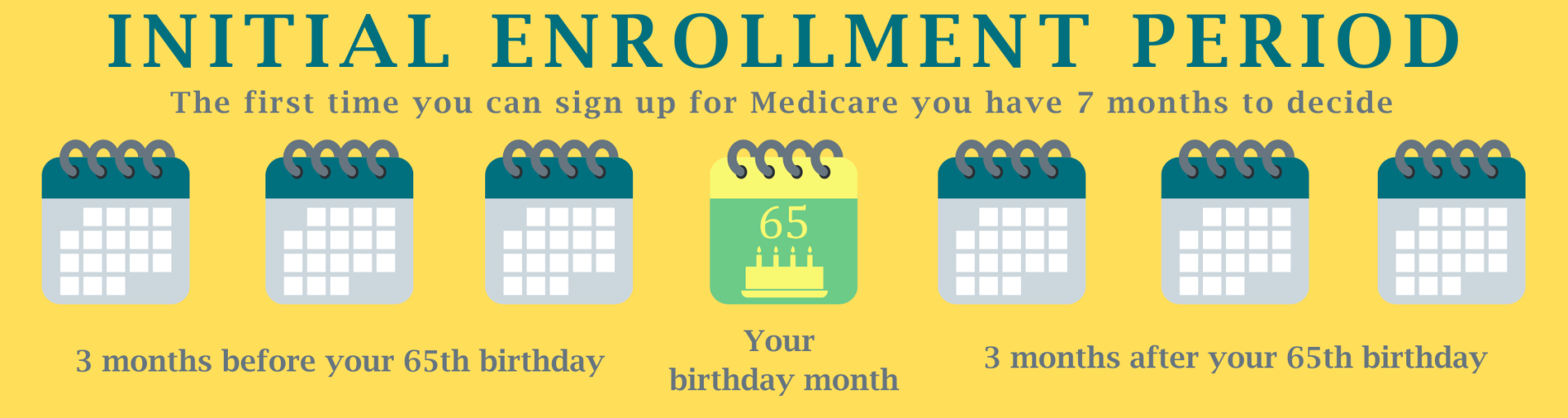

Initial Enrollment Period (IEP)

Your initial enrollment period begins three months before the month you turn 65, the month that you turn 65 and the three months after the month you turn 65. In total, you have seven months to decide on your Medicare coverage.

If you are Medicare eligible due to a disability, your timeline surrounds the 25th month of disability; the three months before the 25th month, the 25th month, and the three months after the 25th month. Ideally, you want to have your decision made in the first three months to avoid enrollment delays!

General Enrollment Period (GEP)

The GEP is for those who missed their Initial Enrollment Period. If you missed your IEP, you can sign up during the GEP (January 1-March 31). Your coverage will begin on July 1st.

Medicare Advantage Open Enrollment Period (MA-OEP)

Every year you can make a change during the MA-OEP, however, limitations apply. You can change to a different Medicare Advantage Plan or go back to Original Medicare (A & B) and join a Part D drug plan. This period begins Januaary 1-March 31 every year.

Special Enrollment Period (SEP)

You may qualify to make changes to your coverage based on certain life events. This would be called a SEP. Examples include moving out of your current plan’s service area, leaving an employer or union coverage, losing Medicaid eligibility, and your current plan terminating, among others.

Contact Simco Capital if you would like further help in understanding any of the Enrollment Periods or help getting Medicare.

Sign up for our newsletter.