DOL Increases Civil Penalty Amounts for 2024

January 26, 2024

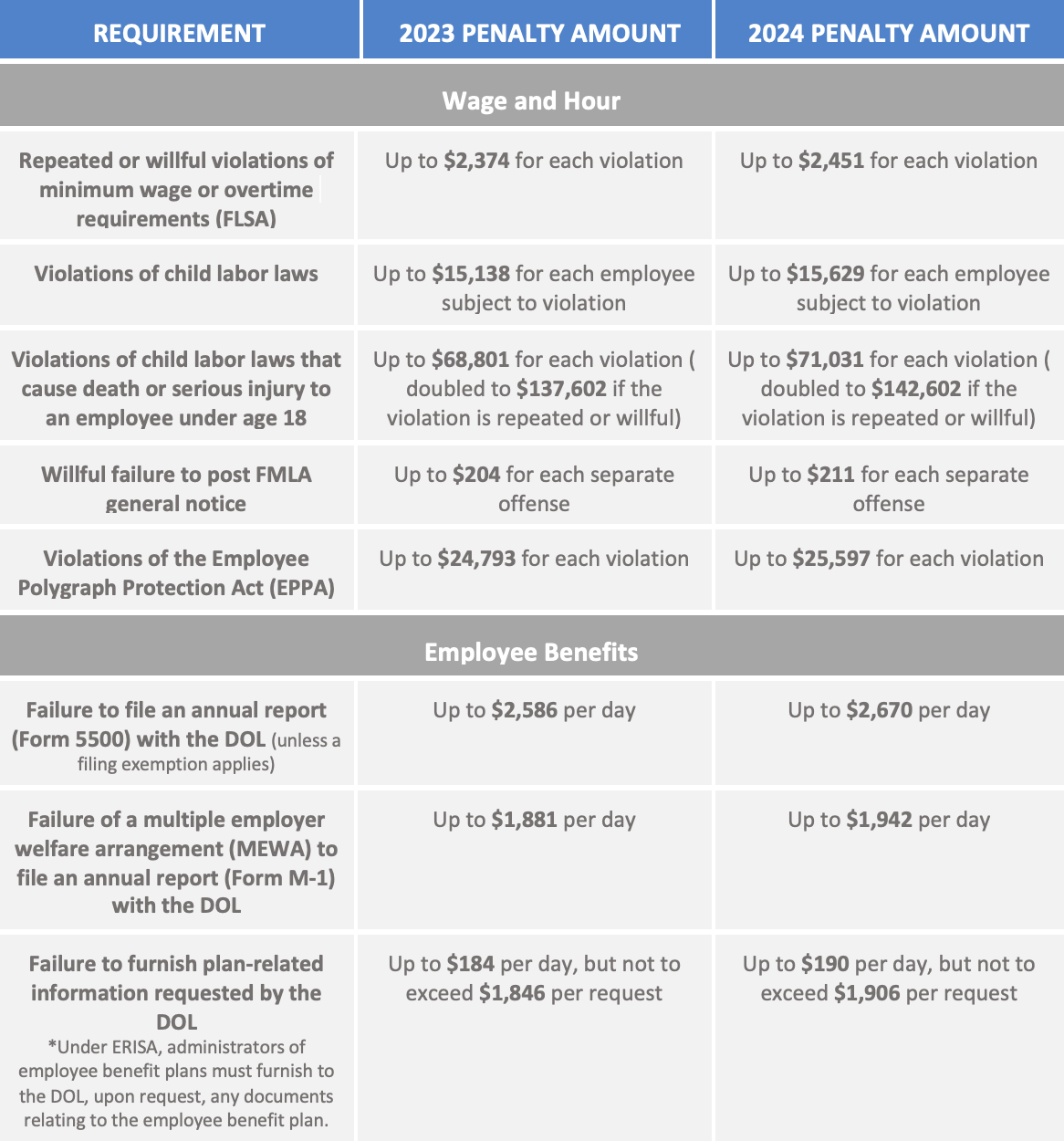

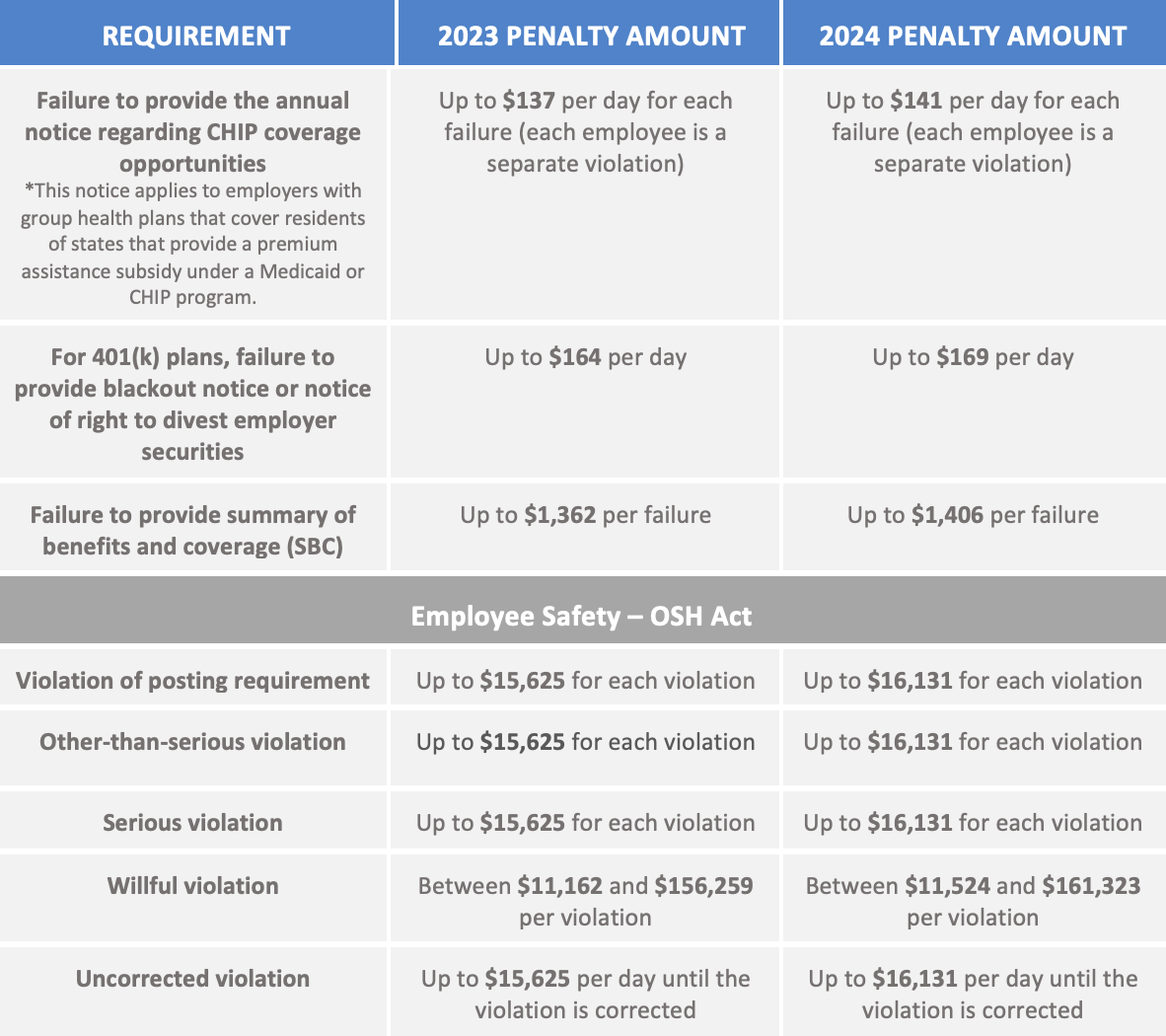

The Department of Labor (DOL) has released its 2024 inflation-adjusted civil monetary penalties that may be assessed on employers for violations of a wide range of federal laws, including:

- The Fair Labor Standards Act (FLSA)

- The Employee Retirement Income Security Act (ERISA)

- The Family and Medical Leave Act (FMLA)

- The Occupational Safety and Health Act (OSH Act)

To maintain their deterrent effect, the DOL is required to adjust these penalties for inflation, no later than Jan. 15 of each year. Key penalty increases include the following:

- The maximum penalty for violations of federal minimum wage or overtime requirements increases from $2,374 to $2,451 per violation.

- The maximum penalty for failing to file a Form 5500 for an employee benefit plan increases from $2,586 to $2,670 per day.

- The maximum penalty for violations of the poster requirement under the FMLA increases from $204 to $211 per offense.

Action Steps

Employers should become familiar with the new penalty amounts and review their pay practices, benefit plan administration and safety protocols to ensure compliance with federal requirements.

Sign up for our newsletter.

Hiring interns—especially during the summer—can offer tremendous value to both the student and the employer. It provides an opportunity for students to gain valuable work experience while helping businesses bring in fresh perspectives and support on key projects. However, in addition to designing meaningful experiences, organizations must also navigate important legal and practical considerations, particularly around compensation. Should Interns Be Paid? While some internships are unpaid, it’s widely recommended—especially by career services professionals—that students receive at least minimum wage. Interns often contribute significantly to workplace operations and may perform tasks similar to those of regular employees. The Fair Labor Standards Act (FLSA) does not specifically define “intern” or provide a blanket exemption for them. That said, most HR and legal experts agree that, unless specific criteria are met, interns should typically be treated as employees and paid accordingly. There are exceptions, such as individuals volunteering for public sector or nonprofit organizations with no expectation of compensation. The DOL’s “Primary Beneficiary” Test To determine whether an intern must be paid, the Department of Labor (DOL) uses a flexible, seven-part test that assesses who primarily benefits from the arrangement—the employer or the intern. No single factor outweighs the others, but the overall context matters. For instance, if the intern is replacing paid staff or if the company directly benefits from their work, it may trigger employee classification. Here are the factors: Both parties understand there’s no expectation of pay. The experience includes training similar to that found in an educational environment. The internship aligns with formal academic programs or offers academic credit. The internship schedule accommodates academic calendars. The experience offers significant educational value over time. The intern’s tasks complement, rather than displace, paid employees. There’s no expectation of a paid job after the internship ends. When in Doubt—Pay If your organization stands to benefit more than the student, it’s safest to classify the intern as an employee. Doing so reduces risk and aligns with legal expectations at both federal and local levels. Remember: even if a program meets federal guidelines, stricter state laws may apply. Wage Requirements for Interns in New York State New York State’s Minimum Wage Act and Wage Orders contain specific rules for pay and overtime. These rules apply in addition to those required by federal law, including the Fair Labor Standards Act. Here are some important considerations for employers in New York State: Paid Internships: Generally, interns must be paid at least the state minimum wage. However, unpaid internships may be acceptable if they meet specific criteria, such as being part of an educational program overseen by an accredited institution that awards academic credit. Exemption from Minimum Wage: An intern may be exempt from minimum wage and overtime requirements if they meet specific criteria set by both the U.S. Department of Labor and the New York State Department of Labor. This includes criteria like the internship being similar to an educational program, benefiting the intern, not displacing regular employees, and having no expectation of a paid job after the internship ends. Paid and Unpaid Internship Clarification: There is no prohibition on an intern receiving academic credit while also being paid, as long as the employer adheres to minimum wage and overtime laws. The training should provide significant educational value, not just be for the employer’s benefit. Nonprofit Organizations and Interns: Not-for-profit organizations may have unpaid interns if they meet all criteria to not be considered in an employment relationship. Compensation and Classification Assuming your interns qualify as employees, they will almost always be classified as nonexempt under the FLSA, meaning they’re entitled to minimum wage and overtime pay. Rates should comply with whichever is highest: federal, state, or local minimum wage. Intern pay often varies by education level and field. According to the National Association of Colleges and Employers (NACE) , the average hourly rate for bachelor’s-level interns has increased annually and is now $23.04 in 2025. High school interns are typically paid minimum wage. Health Benefits for Interns Some employers choose to offer benefits, even though it’s not always required. Larger employers subject to the Affordable Care Act (ACA) may need to provide health insurance to interns classified as seasonal workers, depending on hours and duration of employment. If you’re considering extending benefits, it’s important to consult with your broker and review your benefit plan documents to confirm intern eligibility. Offering health benefits can enhance your organization's image among job seekers and college placement offices, but it also comes with administrative responsibilities—such as managing enrollment and COBRA communications. Best Practices for a Successful Internship Program Before the Internship Begins: Create a clear intern policy outlining job duties, compensation, benefits (if any), and at-will employment status. Assign supervisory roles and evaluation responsibilities to ensure guidance and support. When applicable, obtain documentation from schools confirming the educational value of the internship. Confirm whether your business or the educational institution has insurance that covers interns. Once the Intern Is Onboarded: Provide orientation that includes your company’s mission, policies, and workflows. Clearly explain pay schedules and applicable benefits. Review child labor laws if hiring minors. Be mindful of hour and duty restrictions for younger workers. Always check your state’s specific labor laws and requirements, such as work permits for minors. Final Thoughts Whether paid or unpaid, interns should be treated with the same care and oversight as regular employees. This includes timekeeping for pay accuracy, applying company policies uniformly, and ensuring workplace protections are in place. Interns may still have the right to file claims under federal or state law—even if unpaid—if workplace violations occur. A well-planned internship program not only benefits the student’s development but can also provide your business with fresh perspectives and assistance on key projects. Being proactive and compliant helps create a successful experience for all involved.

It’s April 15—Tax Day in the U.S.—and if you’re a business owner or HR professional, chances are W-2s, filings, and compliance have been front and center for weeks (if not months). But here’s the thing: tax season doesn’t have to be stressful. The right payroll and HCM technology can turn what’s traditionally a time-consuming, error-prone scramble into a streamlined, accurate, and surprisingly painless process. From automatically balancing year-to-date totals to generating and distributing W-2s on time, a robust payroll system ensures nothing slips through the cracks. No more cross-checking data across platforms, no more last-minute tax filings, and no more anxiety about penalties or missed deadlines. At Simco, we get it—because we help businesses simplify this process every single day. The Challenges of Traditional Payroll Tax Management If you're still managing payroll taxes manually—or using disconnected software systems—it’s all too easy to fall behind. Some common issues employers face include: Human error : Tax calculations, forms, and deadlines are complex. A small mistake can lead to penalties or costly overpayments. Time-consuming manual work : Without automation, payroll processing can involve endless imports, exports, and reconciling data across multiple platforms. Compliance risk : With ever-changing tax laws at the federal, state, and local levels, staying compliant can become overwhelming without the right tools. How the Right Technology Can Make Tax Season a Breeze Today’s modern payroll and HCM systems are designed to simplify these challenges. Here’s how the right technology can help: 1. Automated Tax Filing and Payments: An integrated payroll system automates tax calculations, deductions, and filings. Forms like W-2s and W-3s are automatically generated, filed, and paid—without manual input. This reduces the risk of late filings, penalties, and missed deadlines, ensuring compliance with the IRS and state tax agencies. 2. Streamlined W-2 Management: W-2s can be a headache to manage—especially if you have complex tax scenarios like multi-state employment. With an automated system, W-2s are generated and distributed electronically, ensuring accuracy even in complex situations. Employees receive the correct form without you having to spend valuable time cross-checking or manually making corrections. 3. Self-Balancing Capabilities: A self-balancing payroll system ensures that your year-to-date totals and tax filings are accurate, eliminating the need for extensive manual reconciliation. By automatically matching figures in real-time, it streamlines year-end reporting, providing peace of mind when the filing deadline approaches. 4. Fewer Third-Party Imports and Exports: With everything integrated into a single platform, you won’t need to rely on third-party software or services for tax filing and reporting. This means fewer opportunities for errors, fewer manual imports and exports, and significant time saved during payroll processing. 5. Automated Adjustments and Updates: Tax laws and rates change frequently. With the right payroll system, you won’t have to worry about manually updating deductions or tax rates. The system automatically applies changes—whether it’s an update to federal tax rates or state-specific deductions—so your payroll is always up to date. 6. Expert Support When You Need It: Even with the best technology, tax season can present complex challenges. That’s why it’s important to have access to expert support. Whether you need help with multi-jurisdiction filings, audit preparation, or just have questions about tax return procedures, our team of HCM Specialists at Simco is here to provide guidance and ensure that you’re compliant every step of the way. Why Choose Simco for Smarter Payroll and Tax Management? As an isolved Network Partner, we offer a fully integrated payroll and tax management system that is built to handle the complexities of tax season—and beyond. We provide businesses with the tools they need to automate tax filings, ensure compliance, and streamline payroll processing. Here's how we do it: All-in-One Payroll & Tax Platform : From payroll processing to tax deposits and W-2 filings, everything happens within one system, reducing manual work and the risk of errors. Automatic Filing & Timely Accuracy : Federal, state, and local tax filings are completed automatically and on time, ensuring your employees receive only one accurate W-2 form—even in multi-state tax scenarios. Error-Free Tax Reporting : Our self-balancing ledger helps reduce errors and simplifies reconciliation, making tax reporting easier and faster. Expert Support : Whether it’s navigating multi-jurisdictional filings, preparing for an audit, or handling amendments, our team is always available to offer expert advice and assistance. Cost-Effective Solutions : We offer top-tier tech at competitive pricing, often matching or beating our competitors (learn about the Simco Price Match Commitment here !), while providing the personalized service that large providers can’t. Let’s Make Next Tax Season Easier, Starting Today It’s never too early to think about next year. With our unified payroll/HCM solution at Simco, you can save time, reduce stress, and ensure compliance all year long. It’s time to upgrade your payroll system to one that works smarter, not harder. Let’s chat and explore how we can help streamline your payroll and tax processes, so you can focus on growing your business with confidence.

New month, fresh start! But let’s be real—how many times have you set a goal, only to watch it fizzle out? Maybe it was too vague, too ambitious, or just got buried under the daily chaos. If you’re tired of spinning your wheels, it’s time to take a smarter approach—literally. Enter SMART goals —your secret weapon for turning ideas into reality. Whether you’re looking to improve employee retention, streamline operations, or boost revenue, this framework ensures your goals don’t just sound good but actually get done . The SMART Formula for Success Specific – Get laser-focused. A goal like “improve employee morale” is too broad. Instead, ask yourself: What does success look like? Are you reducing turnover? Increasing engagement scores? Define it. Measurable – Numbers don’t lie. How will you know if you’ve succeeded? Instead of saying, “increase engagement,” set a target: “Boost employee engagement scores by 5%.” Tracking progress keeps you accountable. Achievable – Dream big, but stay realistic. Sure, we’d all love zero employee turnover, but is it feasible? Probably not. However, reducing turnover by 15%? Now that’s a goal within reach. Relevant – Align with the bigger picture. Every goal should move your business forward. If your focus is employee retention, then prioritizing revenue growth over culture initiatives might not be the best move. Keep your goals aligned. Time-Bound – Set the clock. “Improve retention” is a nice thought, but without a deadline, it’s just wishful thinking. Instead, say, “Increase retention by 5% by the end of the year.” A firm timeline drives action. Track It or Lose It A goal without tracking is just a wish. You wouldn’t set out on a road trip without checking the map, so why leave your goals to chance? Regular progress check-ins—whether through weekly reports, monthly reviews, or real-time dashboards—help keep you on course. Tracking not only highlights wins but also flags roadblocks early, giving you the chance to pivot before it’s too late. And here’s the key: don’t just track for the sake of tracking—use the data to refine your approach. For example, imagine you're aiming to improve employee engagement scores by 5% by the end of the year. After tracking progress for a few months, you notice that engagement is lagging in one department. Instead of waiting until the year-end review, you dig deeper. Perhaps it’s due to lack of recognition or unclear communication—adjustments are made, and suddenly, the department starts seeing improvement. Tracking allows you to course-correct in real-time, ensuring that you hit your target rather than missing the mark. The most successful businesses aren’t the ones that never face setbacks—they’re the ones that track, adapt, and push forward. How We Use SMART Goals to Stay Ahead At Simco, we don’t just talk about SMART goals—we live by them. Our team follows the Entrepreneurial Operating System (EOS) , which helps us stay focused, aligned, and results-driven. A big part of EOS is setting Rocks —key priorities for the next 90 days. And guess what? Every Rock follows the SMART framework: Clearly defined objectives Measurable success markers Challenging yet attainable goals Aligned with our company vision Locked in with a firm 90-day deadline This system keeps us accountable, making sure we’re always moving the needle in the right direction. Your Turn: Take Action Today No more “someday” goals— today is the day to take control. Whether you’re aiming to increase revenue, refine your processes, or boost employee satisfaction, the SMART approach ensures you’re not just busy—you’re making real progress. Need help aligning your HR, payroll, or benefits strategy with your business goals? Simco is here to help . Let’s make this your most productive quarter yet!